Preserving Wealth:

Why Investing in Precious Metals Makes Sense

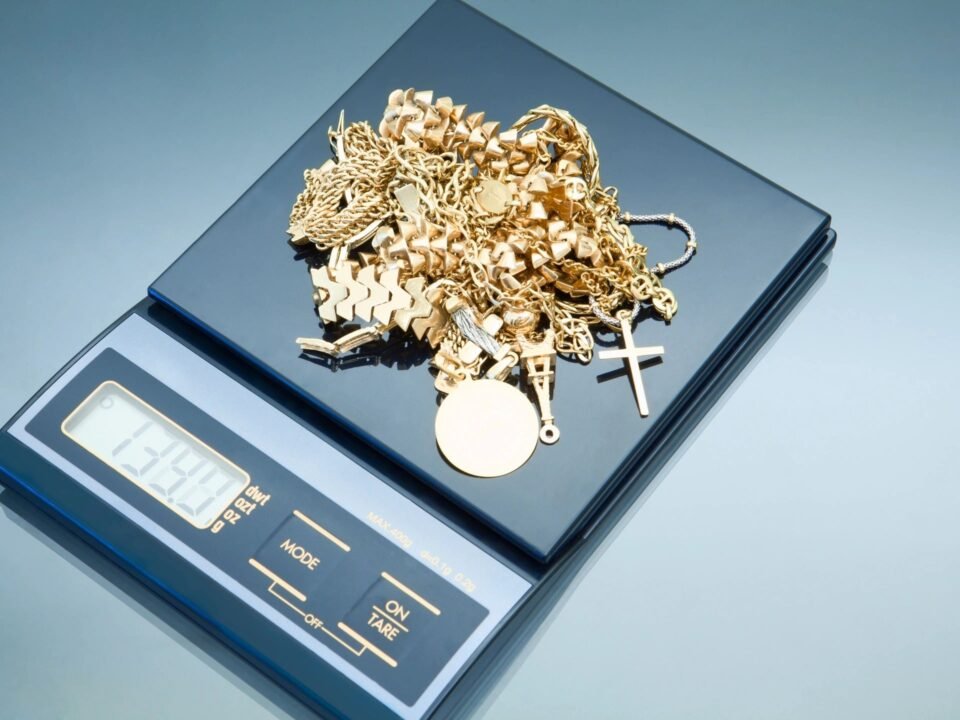

In today's uncertain economic climate, people are searching for ways to protect their wealth and hedge against the devaluation of traditional currencies. One reliable option that has proven itself over time is investing in precious metals, specifically gold and silver. These metals have consistently maintained their buying power, making them an appealing choice for long-term wealth preservation. In this article, we will examine the reasons why investing in gold and silver is a wise strategy, given their historical track record and ability to retain value.

Introduction:

In today's unpredictable economic climate, individuals are increasingly seeking alternative investment options to safeguard their wealth and protect against the devaluation of traditional currencies. One avenue that has stood the test of time is investing in precious metals. Gold and silver, in particular, have consistently demonstrated their ability to retain buying power, making them an attractive choice for investors looking to preserve their wealth over the long term. In this article, we will explore several compelling reasons why investing in precious metals, such as gold and silver, is a prudent strategy.

1. Erosion of the Dollar's Purchasing Power:

The purchasing power of the U.S. dollar has steadily declined over time, as confirmed by the Bureau of Labor Statistics. Inflation erodes the value of fiat currency, diminishing its ability to buy the same goods and services it once could. While moderate inflation is a normal part of any economy, some nations have experienced hyperinflation, which has led to the abandonment or replacement of their fiat currencies. Precious metals offer a hedge against this loss of purchasing power.

2. Historical Track Record:

Unlike fiat currencies, which can be subject to volatility and uncertainty, gold and silver have maintained their value over centuries. The U.S. dollar, for instance, has lost a staggering 97% of its buying power since 1913. In contrast, precious metals have shown remarkable resilience and have served as a store of value throughout history. This stability makes them an attractive investment option for those seeking to preserve their wealth.

3. Silver's Buying Power:

Consider the example of silver. If you had possessed 2,500 ounces of silver in 1965, you would have been able to purchase a Ford Mustang with it. Fast forward to 2021, and that same amount of silver would have enabled you to buy two Ford Mustangs. This illustrates how silver has retained its buying power and has even appreciated in value over time, making it an excellent long-term investment.

4. Gold's Buying Power:

Gold, often referred to as the ultimate safe-haven asset, has also proven to be an excellent store of value. If you had owned 626 ounces of gold in 1965, it would have been sufficient to purchase a single-family home. Keeping that same amount of gold until 2021 would have allowed you to buy three such homes. This impressive growth in purchasing power demonstrates the resilience of gold as an investment.

Conclusion:

Investing in precious metals, such as gold and silver, offers a compelling strategy for preserving wealth and protecting against the devaluation of traditional currencies. The decline in the purchasing power of the U.S. dollar and the erosion caused by inflation highlight the importance of diversifying one's investment portfolio. By allocating a portion of your assets to precious metals, you can benefit from their historical track record of retaining value and even appreciating over time. Whether it's silver's consistent buying power or gold's status as a safe-haven asset, these precious metals provide a tangible and reliable means of safeguarding your wealth in an ever-changing economic landscape.

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!